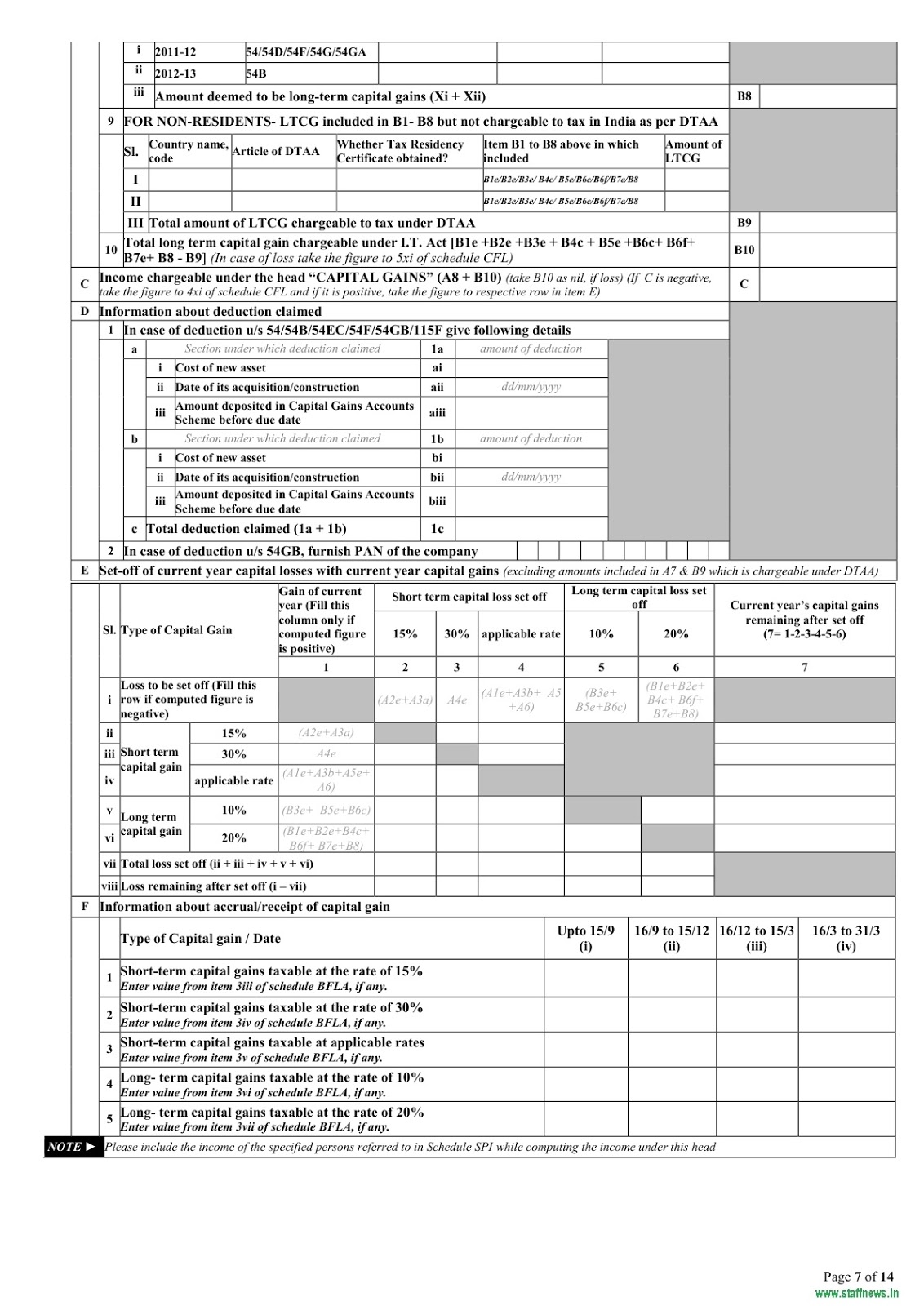

Structure of ITR 2 Filing for AY 2023-24 Online Every year on or before 31st July is termed as the last date for filing ITR 2 (Non-audit cases).Taxpayers who are eligible for Income Tax Return 1 filing.įile ITR 2 Via Gen IT Software, Get Demo!ĭue Date for Filing ITR 2 Online FY 2022-23.Taxpayers who earn from business or profession.The taxpayers who do not require to file the ITR-2 form are as follows: (if there is only long term capital gain exempt u/s 10(38) then ITR-1 can be filed) Both short and long-term capital gains/losses from the sale of property/investments/securities.Income from winnings of a lottery, horse race, gambling, etc.Taxpayers who earn agriculture income above Rs.A non-resident or not-ordinary resident.A resident having any asset located outside India or signing authority in any account.The taxpayers who are eligible for filing the ITR-2 form are the persons whose source of income is as mentioned below: ITR 2 Form Filing Online and Offline ModeĮligible Taxpayers for Filing ITR 2 Online AY 2023-24.Eligibility File ITR 2 Online AY 2020-21.

It includes income from capital gains, foreign income, or any agricultural income more than Rs 5,000. The ITR-2 is filed by the individuals or HUFs not having income from profit or gains of business or profession and to whom ITR-1 is not applicable.

0 kommentar(er)

0 kommentar(er)